With the glut of big-named franchises, independent eye care stores, and online retailers crowding the market, making sure your optical store is competitive is vital to your business’ survival.

Whether you’re having cash flow problems, or need funding to launch a new sales promotion, Business Lending Authority offers small business loan alternatives that can help your optical store prosper. Don’t waste time trying to get a small business loan from banks and traditional lenders who make it impossible for optical stores to qualify. Use our services to acquire fast and easy optical store financing that can help revitalize your business. With optical store financing from Business Lending Authority, you could have $1,000 to $1,000,000 in unsecured business financing in just two days!

Optical Store Financing : Cover Your Expenses With Optical Store Financing from Business Lending Authority

Running an optical store is costly and there are a number of operating expenses that cut into your profits. Maintaining inventory, covering payroll, or renting out a larger office space requires a great deal of operating capital and many optical stores are shuttered each year due to a lack of funding. Business Lending Authority optical store financing can help you cover operating costs, hire more workers, pay for upgrades such as renovations and expansions, or build a new website. Whatever you need, our unsecured business financing will be there to help keep your business running smoothly. Our optical store financing can also be used for:

- Office leases and mortgages

- Franchise fees

- Inventory and supplies

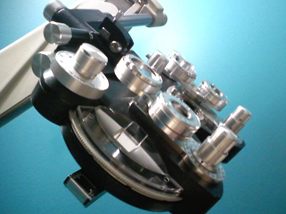

- Lab equipment

- Renovations and office expansions

- Equipment maintenance

- Operations

- Property taxes

- New display cases

- Furniture

- Computers

- Cleaning services

How Our Optical Store Financing Works

Traditional lenders have tough standards that make it nearly impossible for borrowers to qualify for small business loans. In addition to requiring good credit, months of income statements and several years of tax returns, traditional lenders want collateral and personal guarantees. Even if — by some miracle — you do qualify, it takes months to hear back from them, and even longer to get access to your loan. Getting optical store financing from Business Lending Authority is an easy and straightforward process that only takes a few days. We accept business owners with good or bad credit, and contact you within 48 hours of applying to let you know if you qualify for our unsecured business financing. We have a 90% approval rate, which increases the likelihood that you will be eligible for our optical store financing. Think about it. Instead of waiting months on end to hear back from a traditional lender, you could have a $1,000 to $1,000,000 cash advance working for you, allowing you to hire a new optician or to order a several new lines of eye glass frames from a vendor.

What You Need to be Eligible for Optical Store Financing

- Fill out the simple application form on the side of this page

- Must be a optical store that has been operating for at least 6 months. No start ups.

- Speak with a Business Lending Authority representative to complete a few easy steps

- Must have monthly gross sales of $15,000 or higher.

What You Don’t Need

- Good credit

- Collateral which you could lose or demands for liens on your property.

- Restrictions on how you use the money you apply for.

- Traditional business loans that take months to obtain, if you pass all the strict requirements.

Reap the Benefits of Optical Store Financing from Business Lending Authority

Business Lending Authority employs a team of optical store experts who understand the costs associated with running an eye care business. We know that there is more to operating an optical store than selling eye glasses, contact lenses, sun glasses and performing eye exams. The costs of goods and paying staff greatly inflates your overhead, and the lack of an in-house lab can also inflate costs. Our optical store financing will give you the operating capital to help address your business’ needs. Unlike traditional lenders who restrict the ways you can utilize your financing, Business Lending Authority gives you the freedom to use your optical store financing however you see fit. The unsecured business financing can be used to buy new lensometers, pupilometers, and computers or to refurbish the salesroom with new display cases and contemporary furnishings.

Have Access to Ongoing Optical Store Financing from Business Lending Authority

As an added perk, Business Lending Authority offers additional optical store financing after you’ve paid back 70% of the original cash advance. That’s right! You will be eligible for additional unsecured business financing for your optical store, giving you the comfort of knowing that the possibility of getting more operating capital is there if you run into cash flow problems. Banks and other traditional lenders require 95 to 100 percent of small business loans to be repaid before they will allow you to reapply for an additional loan. Which means going back through the months-long application process to find out if you qualify. Waiting several months to hear back from them could cause you to miss out on customers who are looking to spend top-dollar for the latest sunglasses. Fast optical store financing from Business Lending Authority will pay off when you build a new eye examination room, or open an in-house lab that slashes your expenses in half and decreases customer wait times for eye glasses and contact lenses. Our ongoing optical store financing can also help you expand operations to meet the demands of your increasing client list.

Have a Bright Future with Optical Store Financing from Business Lending Authority

Stand above the fray with optical store financing from Business Lending Authority. Simply fill out the form on the side of this page to get the optical store financing you need to make your business the preferred choice for your all of your customers’ eye care needs. One of our representatives will call you to help walk you through the simple process. Apply now!